How to donate stocks to Backpack Buddies

- Instruct your broker. Download and complete this form.

- Send a copy of the form to Backpack Buddies so we’re aware of your gift. Contact details are on the form.

Once Backpack Buddies receives the transferred shares, we’ll issue you a tax receipt.

Benefits of donating stocks and securities

The information provided is not intended as legal or financial advice. We encourage you to consult a qualified Financial Advisor.

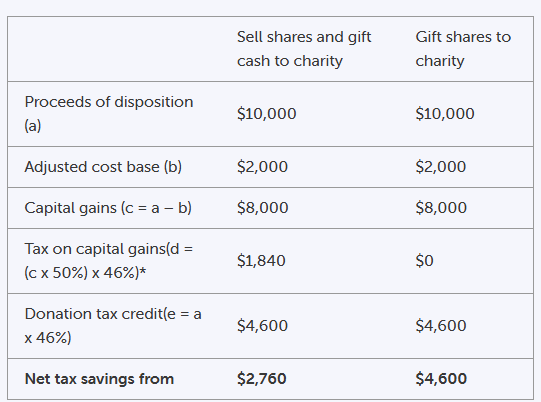

When you donate stock, you can actually give more to Backpack Buddies—as much as 20 percent more. That’s because donations of publicly traded securities, like shares, mutual funds, and stock options, are exempt from capital gains tax.

Your gift of stock is entitled to a donation receipt for the full market value (resale) of your contribution.

In addition to a tax break, your gift of securities generates a non-refundable tax credit that has the effect of lowering your income taxes. You can use your tax credit in the year of your gift or carry it forward for up to five additional years.

For example, $10,000 donated in shares would mean nearly $2,000 more for Backpack Buddies, compared with selling the stock and donating cash.

*The tax rate paid on your last dollar of taxable income.

This example is for illustration purposes only. Please consult your financial and/or legal advisor for tax-effective giving that is most suitable for you. Your charitable receipt will be valued based on the closing price on the day when the shares are legally transferred to Backpack Buddies’ account.